Going to the doctor can be a complicated process. Trying to understand insurance only complicates it further. Sometimes, you may leave the office more perplexed about your insurance coverage than the doctor’s medical advice.

We understand your dilemma and you’re not alone. Here are some of the most frequently asked questions about insurance and payments, along with our answers.

How Much Will I Pay for a Doctor’s Visit?

The exact cost of a doctor’s visit depends on your insurance coverage, or if have insurance at all. If you have a insurance with a copay, expect to pay that amount each time you visit the office.

What is My Insurance Copay and What Does it Cover?

The insurance copay is a consistent amount that the patient pays to the doctor’s office. This only covers the office visit. Basically, a copay pays for the physician’s exam, but it does not cover procedures done as a part of that visit. Procedures such as wart removal, mole removal, and any other treatments completed during the appointment have an additional charge.

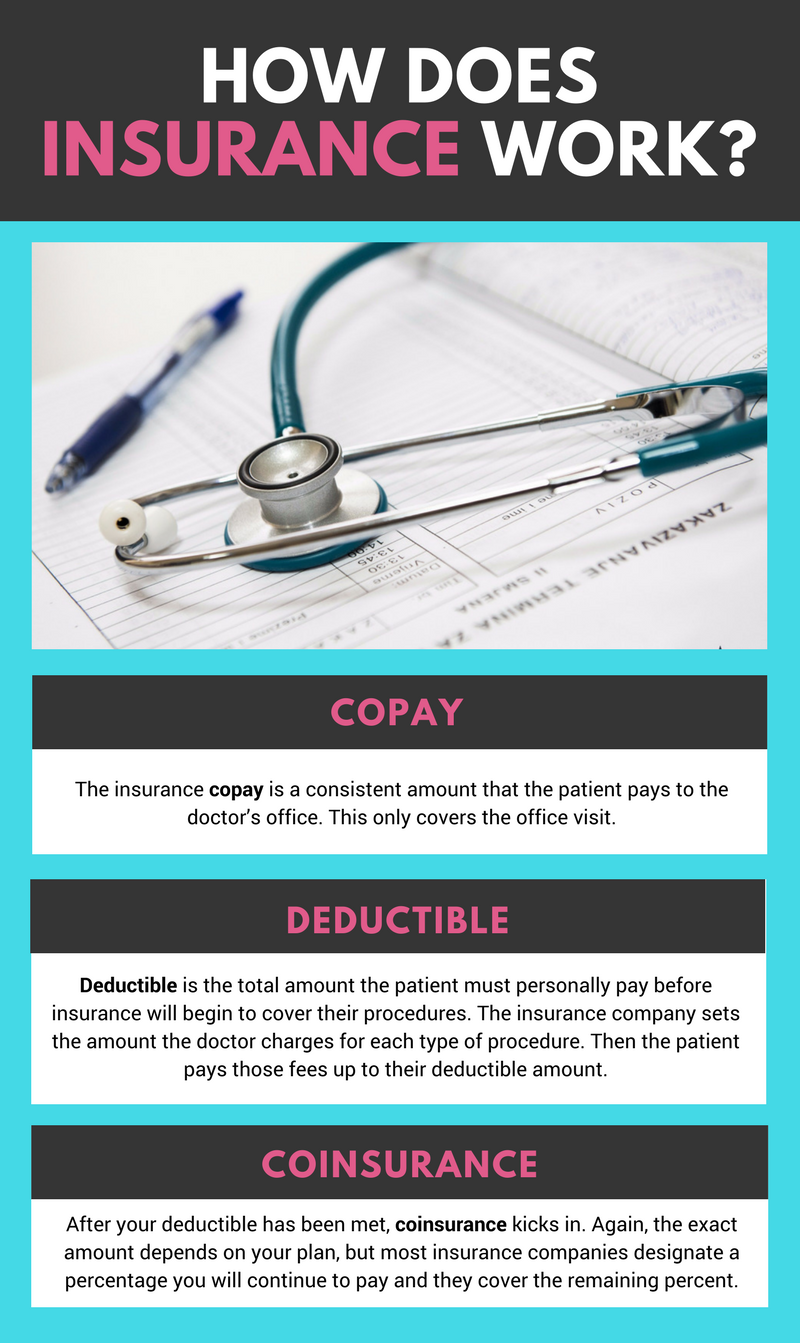

How Does Insurance Work?

Insurance essentially has 3 components that factor into the price you pay: deductible, copay, and coinsurance. You must familiarize yourself with your plan to figure your own dollar amounts. However, understanding the basics of these factors will help you know how those numbers may actually play out.

We’ve already discussed copay, the portion of the office visit fee for which you are responsible. That amount should remain consistent from one visit to the next.

Deductible is the total amount the patient must personally pay before insurance will begin to cover their procedures. The insurance company sets the amount the doctor charges for each type of procedure. Then the patient pays those fees up to their deductible amount.

Let’s say you come to the dermatologist and have a wart frozen. The insurance company designates the fee for treating a wart. The patient pays that amount directly to the doctor if the deductible hasn’t been met. So, if your deductible is $1000.00, you’re responsible for the first $1000.00 owed from your procedures.

After your deductible has been met, coinsurance kicks in. Again, the exact amount depends on your plan, but most insurance companies designate a percentage you will continue to pay and they cover the remaining percent.

Let’s say your coinsurance payment is 20%. That means that your insurance pays 80% of expenses after the deductible. If you have met your deductible, meaning you’ve paid $1000 total for your procedures this year, and you have a $100 charge, you will pay $20 and your insurance company will pay the remaining $80.

Why Aren’t All My Procedures Covered By My Insurance?

Insurance only pays for issues causing a problem. This means if you want a procedure for personal reasons, but it’s not causing a diagnosable problem, insurance won’t pay. Moles and spots, for example, are sometimes covered and other times refused.

If a mole or spot is painful or bleeding, insurance works just as we described above. On the other hand, if they are not painful, bleeding, or causing concern, insurance doesn’t pay to remove spots just because you wanted them removed. Insurance calls those procedures “cosmetic.”

Often non-irritated spots, moles, and skin tags fall into this category. Unfortunately, patients pay out of pocket for any cosmetic procedures. These payments do not contribute towards their insurance deductibles.

Now that you’re a little more informed about the way insurance works, take some time to familiarize yourself with your own health plan. Your doctor’s office should be willing to help, but it’s best to understand your specific insurance coverage. Know what to expect so you can have one less concern on your next visit!

Need to schedule an appointment? Give us a call!

Dr. R. Todd Plott is a board-certified dermatologist in Coppell, Keller, and Saginaw, TX. His specialization and professional interests include treating patients suffering with acne, identifying and solving complex skin conditions such as psoriasis, rosacea, atopic dermatitis, and identifying and treating all types of skin cancers. In his spare time, Dr. Plott enjoys cycling, traveling with his wife, and spending time with his children and new grandson.

Learn more about Dr. Plott.